Here at GWI we publish a steady stream of blogs, reports, and other resources that dig deep into specific market research topics.

But what about the folks who’d appreciate a more general overview of market research that explains the big picture? Don’t they deserve some love too?

Of course they do. That’s why we’ve created this overview guide focusing on types of market research and examples. With so many market research companies to choose from, having a solid general understanding of how this sector works is essential for any brand or business that wants to pick the right market research partner.

So with that in mind, let’s start at the very beginning and get clear on…

Market research definition

At the risk of stating the slightly obvious, market research is the gathering and analyzing of data on consumers, competitors, distributors, and markets. As such it’s not quite the same as consumer research, but there’s significant overlap.

Market research matters because it can help you take the guesswork out of getting through to audiences. By studying consumers and gathering information on their likes, dislikes, and so on, brands can make evidence-based decisions instead of relying on instinct or experience.

What is market research?

Market research is the organized gathering of information about target markets and consumers’ needs and preferences. It’s an important component of business strategy and a major factor in maintaining competitiveness.

If a business wants to know – really know – what sort of products or services consumers want to buy, along with where, when, and how those products and services should be marketed, it just makes sense to ask the prospective audience.

Without the certainty that market research brings, a business is basically hoping for the best. And while we salute their optimism, that’s not exactly a reliable strategy for success.

What are the types of market research?

Primary research

Primary research is a type of market research you either conduct yourself or hire someone to do on your behalf.

A classic example of primary research involves going directly to a source – typically customers or prospective customers in your target market – to ask questions and gather information about a product or service. Interviewing methods include in-person, online surveys, phone calls, and focus groups.

The big advantage of primary research is that it’s directly focused on your objectives, so the outcome will be conclusive, detailed insights – particularly into customer views – making it the gold standard.

The disadvantages are it can be time-consuming and potentially costly, plus there’s a risk of survey bias creeping in, in the sense that research samples may not be representative of the wider group.

Secondary research

Primary market research means you collect the data your business needs, whereas the types of market research known as secondary market research use information that’s already been gathered for other purposes but can still be valuable. Examples include published market studies, white papers, analyst reports, customer emails, and customer surveys/feedback.

For many small businesses with limited budgets, secondary market research is their first choice because it’s easier to acquire and far more affordable than primary research.

Secondary research can still answer specific business questions, but with limitations. The data collected from that audience may not match your targeted audience exactly, resulting in skewed outcomes.

A big benefit of secondary market research is helping lay the groundwork and get you ready to carry out primary market research by making sure you’re focused on what matters most.

Qualitative research

Qualitative research is one of the two fundamental types of market research. Qualitative research is about people and their opinions. Typically conducted by asking questions either one-on-one or in groups, qualitative research can help you define problems and learn about customers’ opinions, values, and beliefs.

Classic examples of qualitative research are long-answer questions like “Why do you think this product is better than competitive products? Why do you think it’s not?”, or “How would you improve this new service to make it more appealing?”

Because qualitative research generally involves smaller sample sizes than its close cousin quantitative research, it gives you an anecdotal overview of your subject, rather than highly detailed information that can help predict future performance.

Qualitative research is particularly useful if you’re developing a new product, service, website or ad campaign and want to get some feedback before you commit a large budget to it.

Quantitative research

If qualitative research is all about opinions, quantitative research is all about numbers, using math to uncover insights about your audience.

Typical quantitative research questions are things like, “What’s the market size for this product?” or “How long are visitors staying on this website?”. Clearly the answers to both will be numerical.

Quantitative research usually involves questionnaires. Respondents are asked to complete the survey, which marketers use to understand consumer needs, and create strategies and marketing plans.

Importantly, because quantitative research is math-based, it’s statistically valid, which means you’re in a good position to use it to predict the future direction of your business.

Consumer research

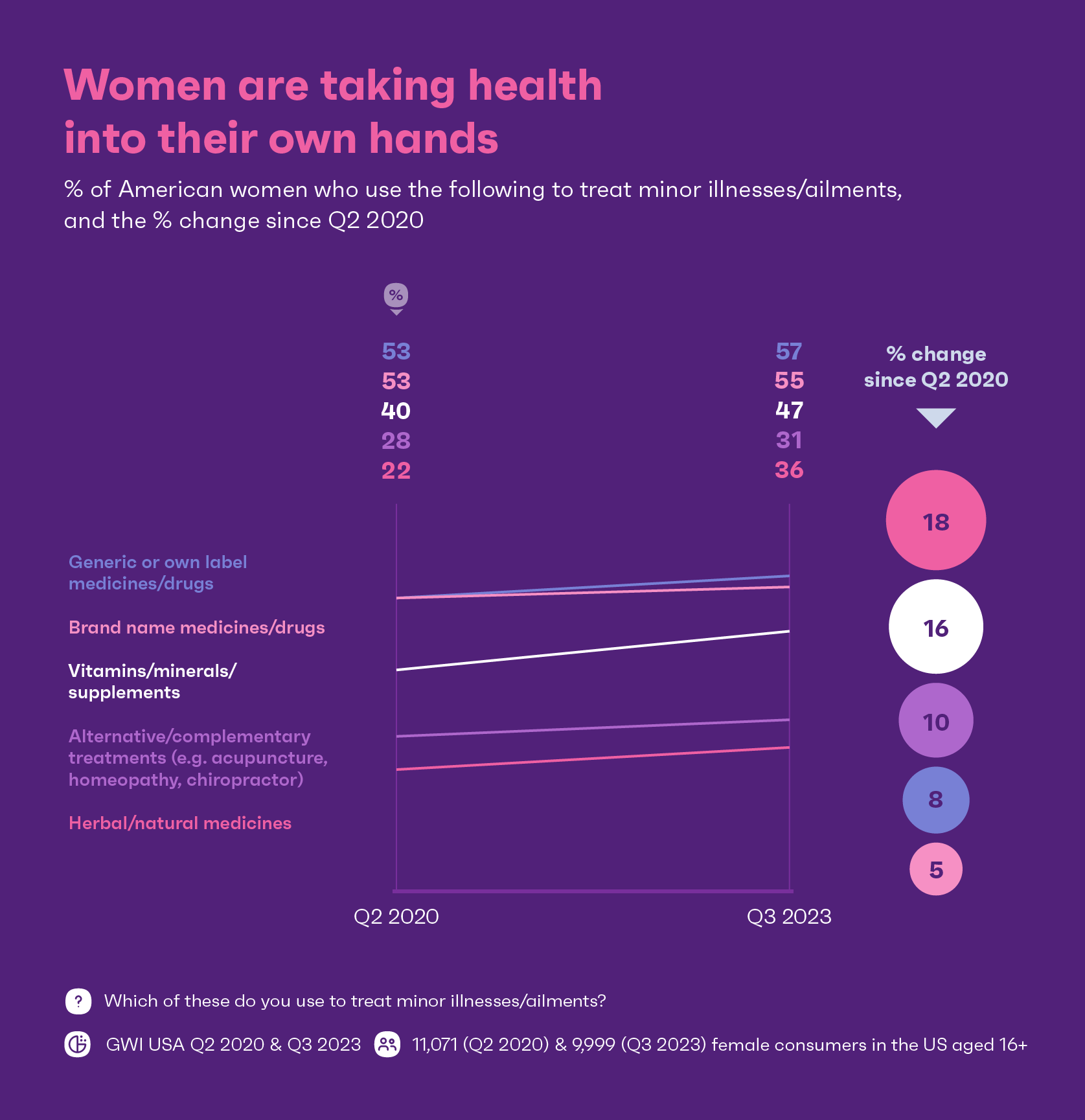

As its name implies, consumer research gathers information about consumers’ lifestyles, behaviors, needs and preferences, usually in relation to a particular product or service. It can include both quantitative and qualitative studies.

Examples of consumer research in action include finding ways to improve consumer perception of a product, or creating buyer personas and market segments, which help you successfully market your product to different types of customers.

Understanding consumer trends, driven by consumer research, helps businesses understand customer psychology and create detailed purchasing behavior profiles. The result helps brands improve their products and services by making them more customer-centric, increasing customer satisfaction, and boosting bottom line in the process.

Product research

Product research gives a new product (or indeed service, we don’t judge) its best chance of success, or helps an existing product improve or increase market share.

It’s common sense: by finding out what consumers want and adjusting your offering accordingly, you gain a competitive edge. It can be the difference between a product being a roaring success or an abject failure.

Examples of product research include finding ways to develop goods with a higher value, or identifying exactly where innovation effort should be focused.

Product research goes hand-in-hand with other strands of market research, helping you make informed decisions about what consumers want, and what you can offer them.

Brand research

Brand research is the process of gathering feedback from your current, prospective, and even past customers to understand how your brand is perceived by the market.

It covers things like brand awareness, brand perceptions, customer advocacy, advertising effectiveness, purchase channels, audience profiling, and whether or not the brand is a top consideration for consumers.

The result helps take the guesswork out of your messaging and brand strategy. Like all types of market research, it gives marketing leaders the data they need to make better choices based on fact rather than opinion or intuition.

Market research methods

So far we’ve reviewed various different types of market research, now let’s look at market research methods, in other words the practical ways you can uncover those all-important insights.

Consumer research platform

A consumer research platform like GWI is a smart way to find on-demand market research insights in seconds.

In a world of fluid markets and changing attitudes, a detailed understanding of your consumers, developed using the right research platform, enables you to stop guessing and start knowing.

As well as providing certainty, consumer research platforms massively accelerate speed to insight. Got a question? Just jump on your consumer research platform and find the answer – job done.

The ability to mine data for answers like this is empowering – suddenly you’re in the driving seat with a world of possibilities ahead of you. Compared to the most obvious alternative – commissioning third party research that could take weeks to arrive – the right consumer research platform is basically a magic wand.

Admittedly we’re biased, but GWI delivers all this and more. Take our platform for a quick spin and see for yourself.

And the downside of using a consumer research platform? Well, no data set, however fresh or thorough, can answer every question. If you need really niche insights then your best bet is custom market research, where you can ask any question you like, tailored to your exact needs.

Face-to-face interviews

Despite the rise in popularity of online surveys, face-to-face survey interviewing – using mobile devices or even the classic paper survey – is still a popular data collection method.

In terms of advantages, face-to-face interviews help with accurate screening, in the sense the interviewee can’t easily give misleading answers about, say, their age. The interviewer can also make a note of emotions and non-verbal cues.

On the other hand, face-to-face interviews can be costly, while the quality of data you get back often depends on the ability of the interviewer. Also, the size of the sample is limited to the size of your interviewing staff, the area in which the interviews are conducted, and the number of qualified respondents within that area.

Social listening

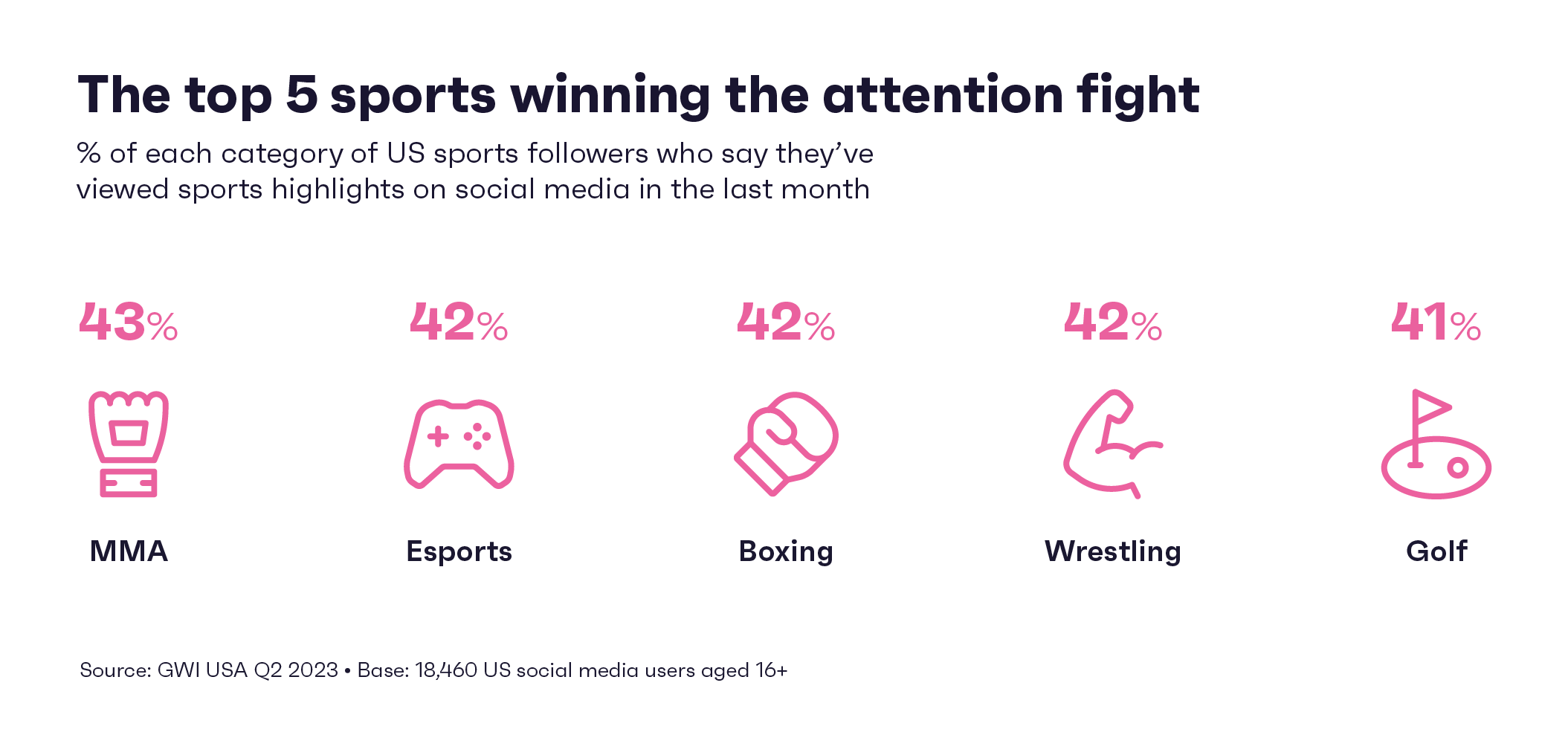

Social listening is a powerful solution for brands who want to keep an ear to the ground, gathering unfiltered thoughts and opinions from consumers who are posting on social media.

Many social listening tools store data for up to a couple of years, great for trend analysis that needs to compare current and past conversations.

Social listening isn’t limited to text. Images, videos, and emojis often help us better understand what consumers are thinking, saying, and doing better than more traditional research methods.

Perhaps the biggest downside is there are no guarantees with social listening, and you never know what you will (or won’t) find. It can also be tricky to gauge sentiment accurately if the language used is open to misinterpretation, for example if a social media user describes something as “sick”.

There’s also a potential problem around what people say vs. what they actually do. Tweeting about the gym is a good deal easier than actually going. The wider problem – and this may shock you – is that not every single thing people write on social media is necessarily true, which means social listening can easily deliver unreliable results.

Public domain data

Public domain data comes from think tanks and government statistics or research centers like the UK’s National Office for Statistics or the United States Census Bureau and the National Institute of Statistical Sciences. Other sources are things like research journals, news media, and academic material.

Its advantages for market research are it’s cheap (or even free), quick to access, and easily available. Public domain datasets can be huge, so potentially very rich.

On the flip side, the data can be out of date, it certainly isn’t exclusive to you, and the collection methodology can leave much to be desired. But used carefully, public domain data can be a useful source of secondary market research.

Telephone interviews

You know the drill – you get a call from a researcher who asks you questions about a particular topic and wants to hear your opinions. Some even pay or offer other rewards for your time.

Telephone surveys are great for reaching niche groups of consumers within a specific geographic area or connected to a particular brand, or who aren’t very active in online channels. They’re not well-suited for gathering data from broad population groups, simply because of the time and labor involved.

How to use market research

Data isn’t an end in itself; instead it’s a springboard to make other stuff happen. So once you’ve drawn conclusions from your research, it’s time to think of what you’ll actually do based on your findings.

While it’s impossible for us to give a definitive list (every use case is different), here are some suggestions to get you started.

Leverage it. Think about ways to expand the use – and value – of research data and insights, for example by using research to support business goals and functions, like sales, market share or product design.

Integrate it. Expand the value of your research data by integrating it with other data sources, internal and external. Integrating data like this can broaden your perspective and help you draw deeper insights for more confident decision-making.

Justify it. Enlist colleagues from areas that’ll benefit from the insights that research provides – that could be product management, product development, customer service, marketing, sales or many others – and build a business case for using research.

How to choose the right type of market research

Broadly speaking, choosing the right research method depends on knowing the type of data you need to collect. To dig into ideas and opinions, choose qualitative; to do some testing, it’s quantitative you want.

There are also a bunch of practical considerations, not least cost. If a particular approach sounds great but costs the earth then clearly it’s not ideal for any brand on a budget.

Then there’s how you intend to use the actual research, your level of expertise with research data, whether you need access to historical data or just a snapshot of today, and so on.

The point is, different methods suit different situations. When choosing, you’ll want to consider what you want to achieve, what data you’ll need, the pros and cons of each method, the costs of conducting the research, and the cost of analyzing the results.

Market research examples

Independent agency Bright/Shift used GWI consumer insights to shape a high-impact go-to-market strategy for their sustainable furniture client, generating £41K in revenue in the first month. Here’s how they made the magic happen.