As more and more people gain access to the internet across the world’s fast-growth markets, there has never been a greater need to understand and profile these digital consumers. As part of the GlobalWebIndex mission to quantify the perceptions and behaviors of every connected consumer, we have extended our research into Egypt – a market with an internet penetration rate of just 36%, but with tens of millions of digital consumers. So what does the digital landscape look like in Egypt and what do marketers looking in its direction really need to know?

1. The Smartphone is the Most Important Device

Typical of many fast-growth markets, smartphones hold particular significance in the Egyptian digital landscape.

86% of Egypt’s internet population own a mobile phone, making this the most commonly owned device, with just under half of all Egyptian internet users saying smartphones are their number one choice for getting online.

In fact, internet users in this market are twice as likely to cite the smartphone as their most important device as they are to cite laptops (26%) or desktop PCs (23%). Moreover, Egypt’s internet penetration rate still sits below the 40% mark, and for most new internet users in this market, mobile is their initial online gateway, meaning we can expect to see mobile devices strengthening their position in the near future.

2. Social Media is Dominating the Online Space

All Egyptian internet users have visited a social network in the past month, with mobiles being cited as the most favored device to gain access (82%), giving these a ten-point lead over PCs/laptops.

With this in mind, it makes sense that Egyptian internet users are devoting more time to social networking than many of the world’s digital consumers across our 40 tracked markets (over 3¼ hours per day).

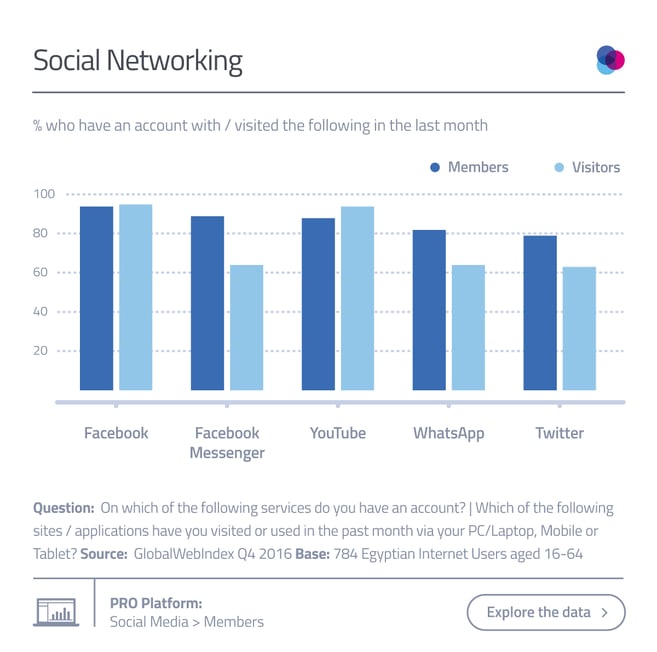

Facebook dominates the social space in Egypt, with Facebook, Facebook Messenger and Facebook-owned WhatsApp seeing the most engagement. Indeed, digital consumers in this market see exceptionally strong figures for all of the major networks and messaging apps. On average, internet users are counted as members of seven out of the top ten social platforms in Egypt.

More broadly, social media’s reputation in Egypt as a vehicle for people to engage with current affairs is clearly demonstrated in our data – consumers in this market are 41% more likely to use social platforms to stay up-to-date with news and current events, and one in two do so.

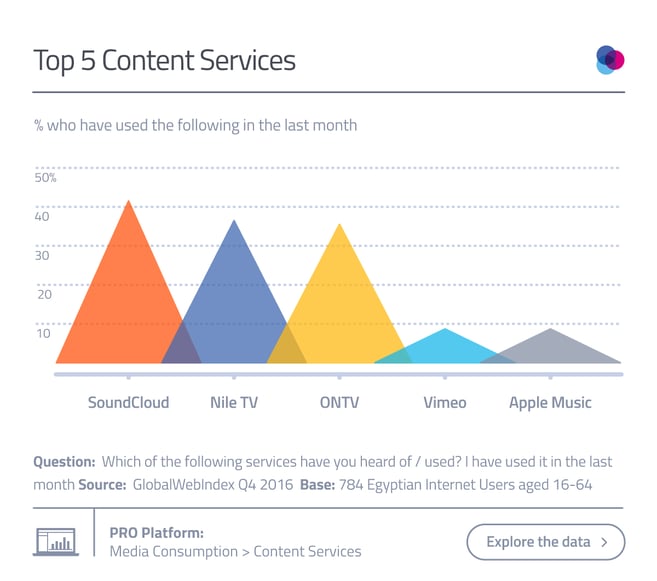

3. Local is Key for Online TV Entertainment

Linear TV is still king in Egypt, but this market is among our top five for online TV consumption, averaging over an hour per day for time spent engaging with this media. A look at the Egyptian online TV entertainment landscape shows an overwhelming preference for local content, with domestic networks Nile TV and ONTV boasting figures three times higher than those related to any other international video-streaming service.

SoundCloud also sees a particularly strong uptake in Egypt, with this being the music streaming service’s top market in our global research by a clear margin.

Again, the inclination towards local content is likely to be having an impact here, with SoundCloud facilitating the spread of unsigned, local artists unavailable on the likes of Apple Music and Spotify.

4. Offline Transactions are Driving Online Commerce

Egyptian internet users are less likely than the global average to be engaging with all the commerce activities we list, but that’s certainly not to say that these consumers are averse to buying online.

Context is key here: Egypt is a primarily cash-driven economy with a relatively undeveloped financial infrastructure, something which has dramatic implications upon how people are able to purchase online.

We can gain a better understanding here if we look at the top online commerce platforms in Egypt. These consumers may under-index significantly for visiting Amazon each month, but they are over three and a half times as likely to be visiting OLX monthly (more than half are). Rather than paying for products online, OLX requires offline transactions for its listed items, something which is crucial in a cash-driven economy like Egypt. So, for many Egyptians, online commerce fulfils only part of the purchase journey, with offline transactions completing the final process.

5. Egyptian Consumers are Open to Online Ads

The proliferation of ad-blocking software continues to be a hot topic among the global marketing industry, with justified fears over the spread of mobile ad-blocking from East to West adding fuel to the fire.

In Egypt however, at least for now, internet users display a remarkably – if somewhat rare – susceptibility to online ads.

Looking at how these consumers typically discover new brands or products; their highest over-indexes are for personalized purchase recommendations on a website or for ads seen online. Couple this with the strong Âunder-indexes seen for both mobile and desktop ad-blocking and we’ve got somewhat of a marketer’s dream.

Among those who are blocking ads in Egypt however, ad-frustration and ad-overload are cited as the primary motivations behind the behavior. For this reason, any efforts looking to stem the tide of ad-blocking in this market need to take note of the wider shift among the global advertising industry towards more creative solutions led by powerful insights and more of a focus on quality over quantity.

Want to know more about the rise of the ad-blocker? Download our free ad-blocking infographic for a detailed look at what’s driving the global trend.